Our Philosophy

Marrying behavioral finance with engineering.

The Artisan Financial Strategies team brings a rigorous and data-driven approach to

financial planning. That’s probably related to the fact that the majority of us have an

engineering background – we often describe our unique style as the intersection of financial

advisory and engineering. In seeking optimal outcomes for clients, we adhere to three key

principles.

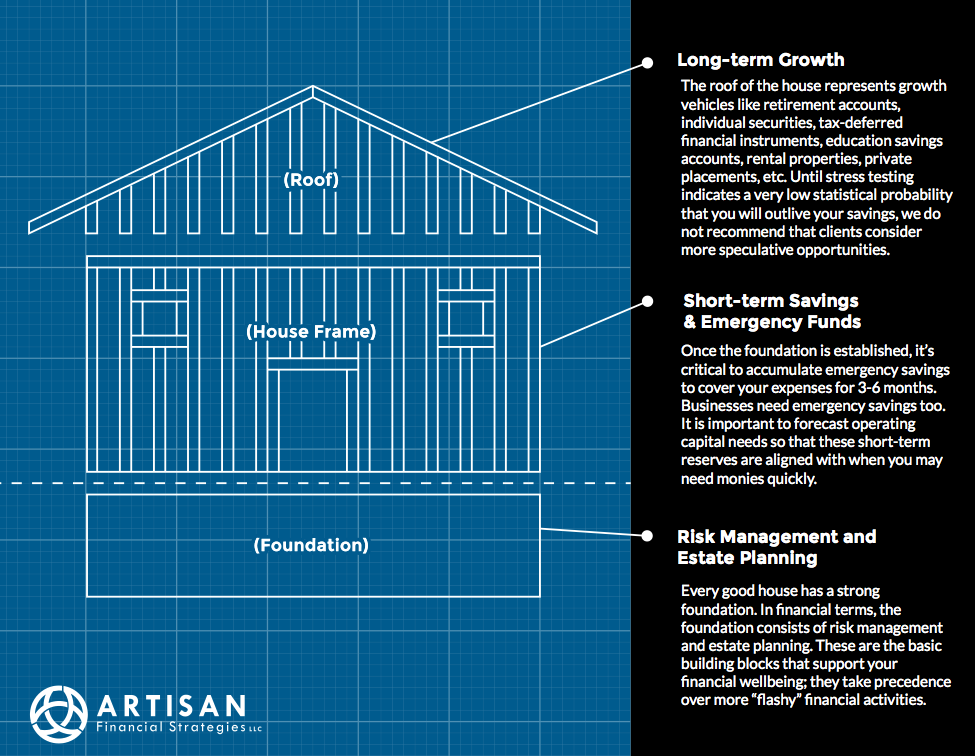

IPrioritize Planning:

The cumulative effects of seemingly trivial choices can have a significant impact on future

wellbeing, so we believe any financial decision should be rooted in a solid financial plan.

That’s why your financial blueprint is so important – with it as a guide, you can move

forward with confidence that each step is taking you closer to your goals. It’s also why we

take the lead in reaching out to your other advisors and actively collaborating with them,

setting up meetings as necessary to effectively coordinate your strategies and provide

seamless support across all aspects of your financial life.

IIEmphasize Education:

We believe that financial education is one of the most valuable services

we provide for clients. Our practice utilizes behavioral finance as a cornerstone of

planning. The natural response to a particular macroeconomic trend or personal situation is

not always the most rational one. As fiduciary agents, part of our job is helping you

protect your portfolio from excessive emotional reactions (e.g. panic-selling during market

downturns). Dr. Daniel Crosby is one of the nation’s foremost behavioral finance experts; as

part of our interview series with leading academics and researchers, we spoke with him to

learn his insights and allow our clients to benefit from the latest developments in this

area. You can access this interview in our Video Learning Library.

IIILeverage Technology:

Artisan Financial Strategies makes a significant investment in advanced technologies in

order to optimize the client experience and help us deliver the best results for you. Tools

like a client command center allow you to securely view all your accounts, investments and

financial documents in one place. We think this is important not just for your convenience,

but also so you can gain a holistic perspective on your financial picture. Behind the

scenes, we use cutting-edge tools and techniques to analyze investment portfolios and run

stress tests based on various scenarios, so we can predict potential performance and ensure

that your plan will stand up against all manner of uncertain circumstances.